The Federal Government has announced a major shift in housing policy: from 1 October 2025, the First Home Guarantee (also known as the expanded Home Guarantee Scheme) will allow all first-home buyers to purchase a property with just a 5% deposit – with no income caps, no cap on places, and no Lenders Mortgage Insurance (LMI).

In practical terms, for a typical Perth property near the new metro cap of $850,000, first-home buyers will need only $42,500 for a deposit – and they’ll avoid paying LMI, which can add tens of thousands to upfront costs.

For many young Australians, this change could cut years off the time it takes to enter the market. For current homeowners, especially in Perth’s northern coastal suburbs, it may also create strong selling conditions over the next 12–18 months.

Key Changes at a Glance

- Lower deposit hurdle: First-home buyers only need 5% saved.

- No LMI: Buyers save tens of thousands by avoiding mortgage insurance.

- Wider eligibility: No income thresholds or limited allocations; every first-home buyer can access the scheme.

- Updated price caps: For WA, that’s $850,000 in Perth and $600,000 regionally.

What This Means for Perth’s Market – and for Sellers

The expanded 5% deposit scheme is set to reshape the market from the bottom up. Here’s how it’s likely to play out in Perth’s northern coastal corridor:

More Buyers, More Movement

With deposits now within reach, first-home buyers can actively compete in the $600k–$850k tier. This creates a flow-on effect: as entry buyers secure homes, sellers in that bracket move upward, opening opportunities at the premium end of the market.

For established owners in Hillarys, Sorrento, Carine, and Kallaroo, this means a larger buyer pool and more competition for homes.

Quicker Market Turnover

Real estate professionals expect faster entry for new buyers to trigger a chain reaction:

- First-home buyers purchase mid-tier homes.

- Sellers in that bracket upgrade into premium properties.

- Established homeowners feel more confident to list.

This flow of activity can shorten selling campaigns, with homes spending fewer days on market.

Record-Low Stock Adds Urgency

Right now, Perth has just 2,981 homes for sale across the entire metro area – the lowest number ever recorded. At our recent Ocean Reef home open, more than 100 groups attended in one weekend, highlighting the depth of buyer demand.

With stock at historic lows and the scheme about to boost buyer eligibility, sellers may benefit from unprecedented competition.

Upward Price Pressure

Major banks including Westpac and AMP are forecasting 8–10% national home price growth by 2026, with this scheme listed as a contributing factor. More qualified buyers in an undersupplied market typically translate into multiple offers and firmer sale prices, especially in high-demand suburbs.

Risks to Watch

Industry experts note potential challenges:

-

- Financial strain: Smaller deposits mean higher levels of debt, leaving some first-home buyers exposed if interest rates rise.

- Supply imbalance: Without new housing stock, rising demand may further impact affordability.

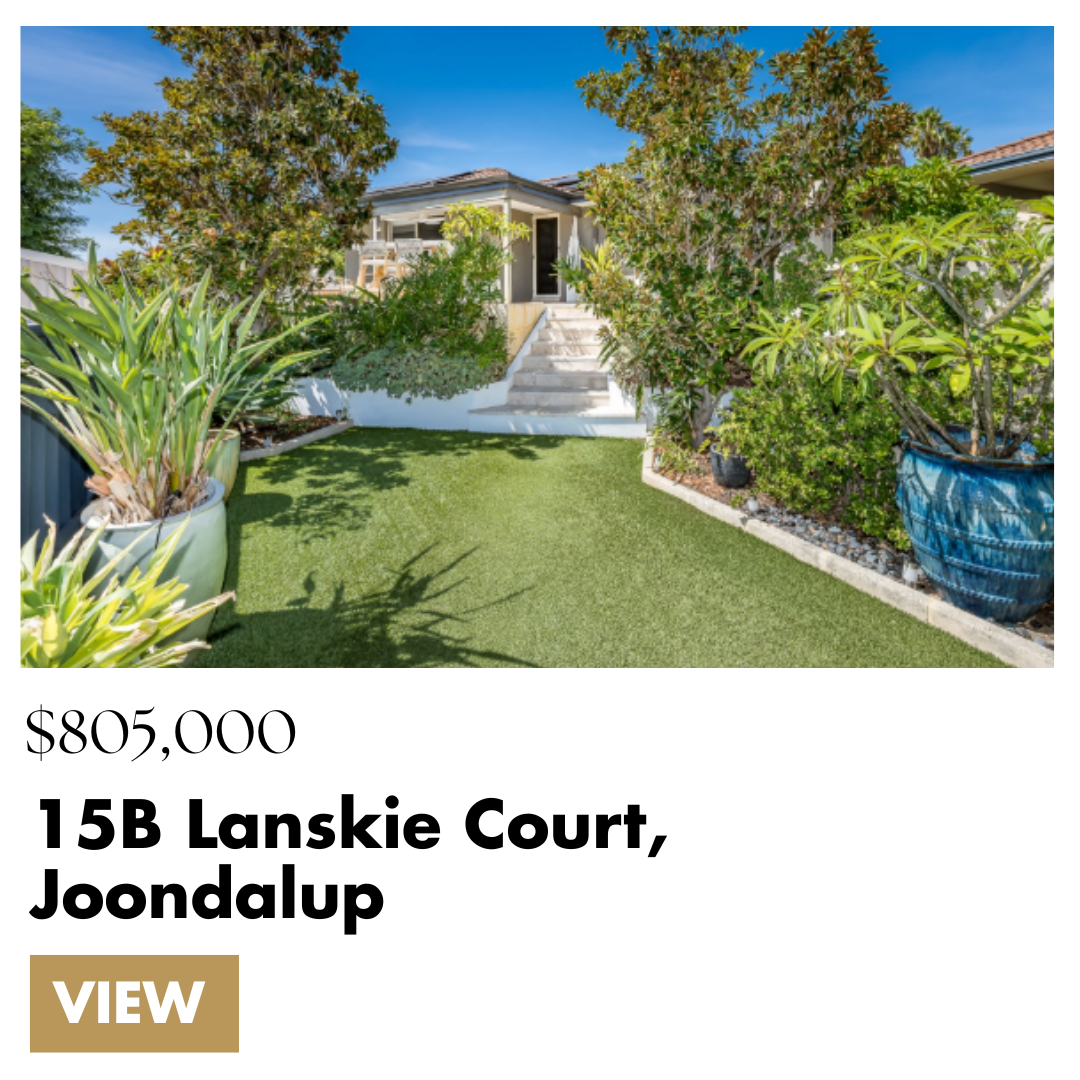

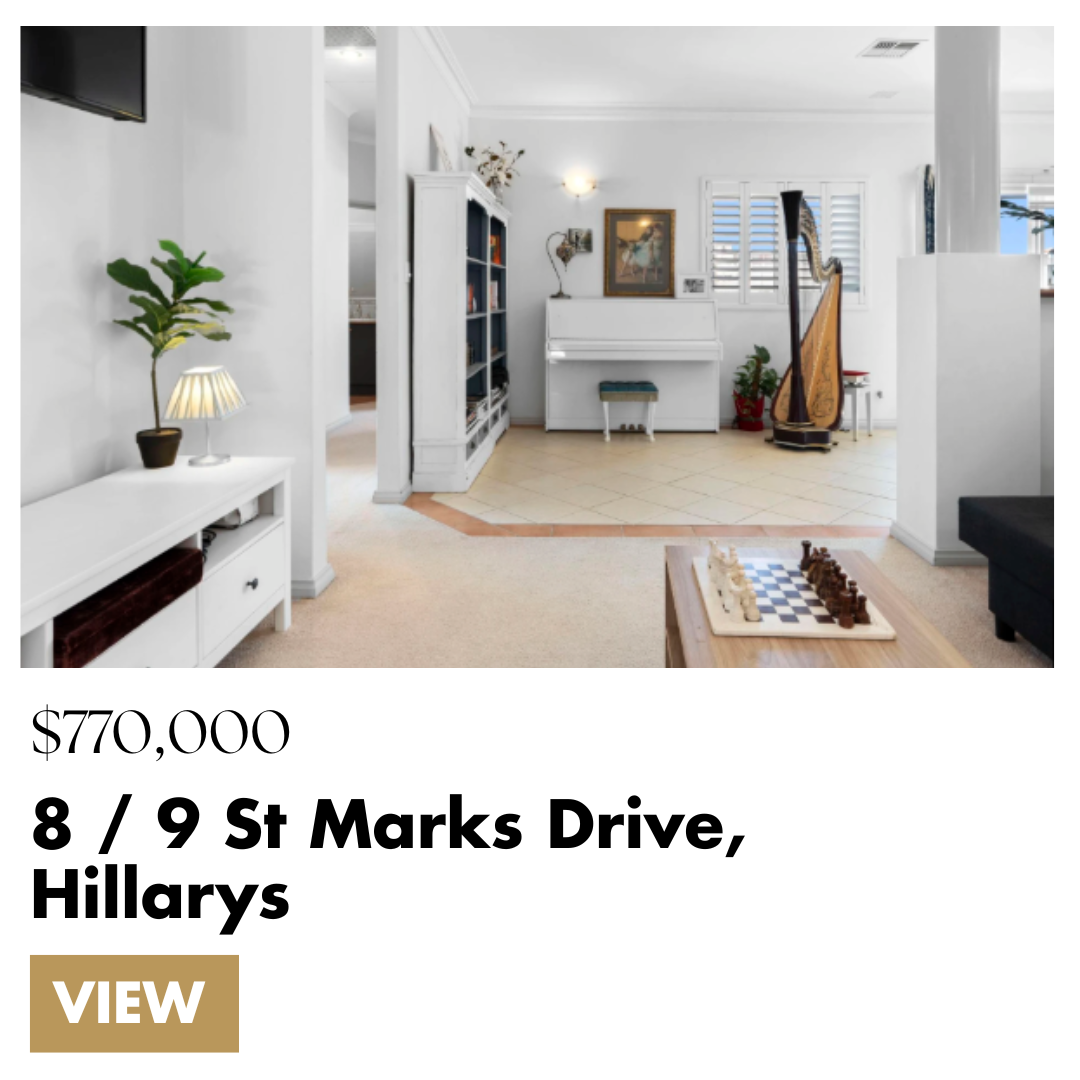

What $850,000 Buys You in Perth’s Northern Coastal Suburbs

With the new $850,000 metro cap in WA, here’s the type of property first-home buyers could now access under the scheme:

Final Thoughts

This is arguably the biggest housing reform in Australia in decades. While designed to assist first-home buyers, it strengthens the property ladder from the bottom up benefiting sellers who time their move well.

If you’re curious about how your suburb may be affected, or want tailored insights for Hillarys, Kallaroo, Sorrento, or Carine, the team at Noble Avenue Real Estate is here to help.

Contact us today for a confidential appraisal and discover how new market conditions could work in your favour.

Figures correct as at 8 September 2025 – Perth metro currently has 2,905 homes for sale. REIWA